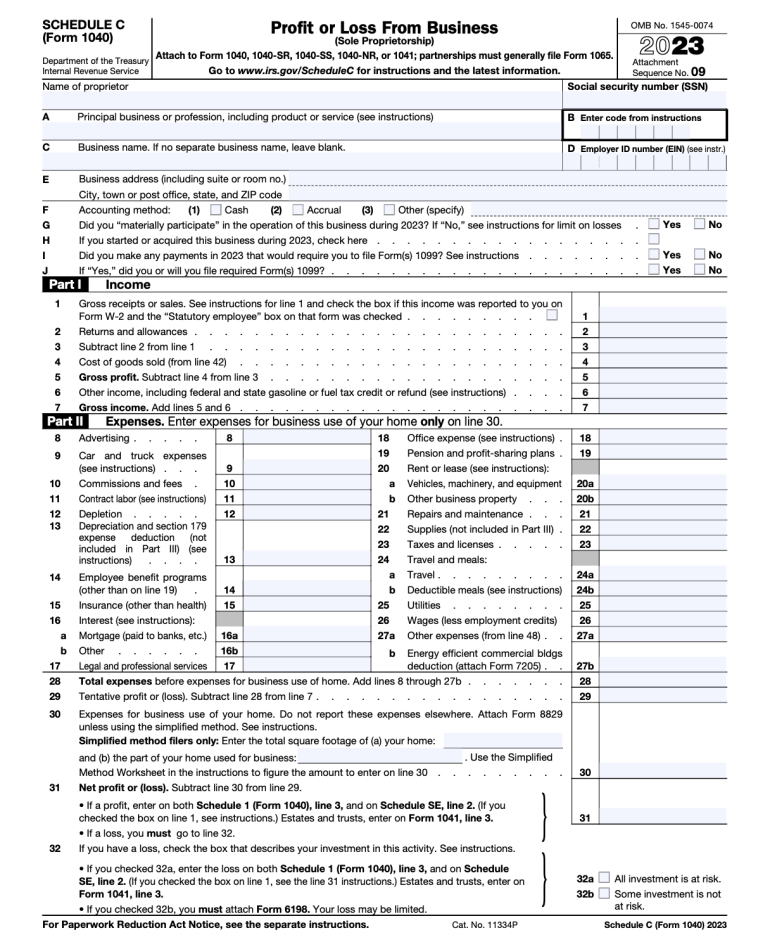

2024 Schedule C Form 1099 – While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security . For example, if you receive a 1099-MISC for $50,000 and only reported $25,000 of gross receipts on your Form 1040 Schedule C, then you will most likely get audited. As a small business owner .

2024 Schedule C Form 1099

Source : falconexpenses.comForm 1099 K: Definition, Uses, Who Must File

Source : www.investopedia.comFlyFin: Effortless 1099 Taxes Apps on Google Play

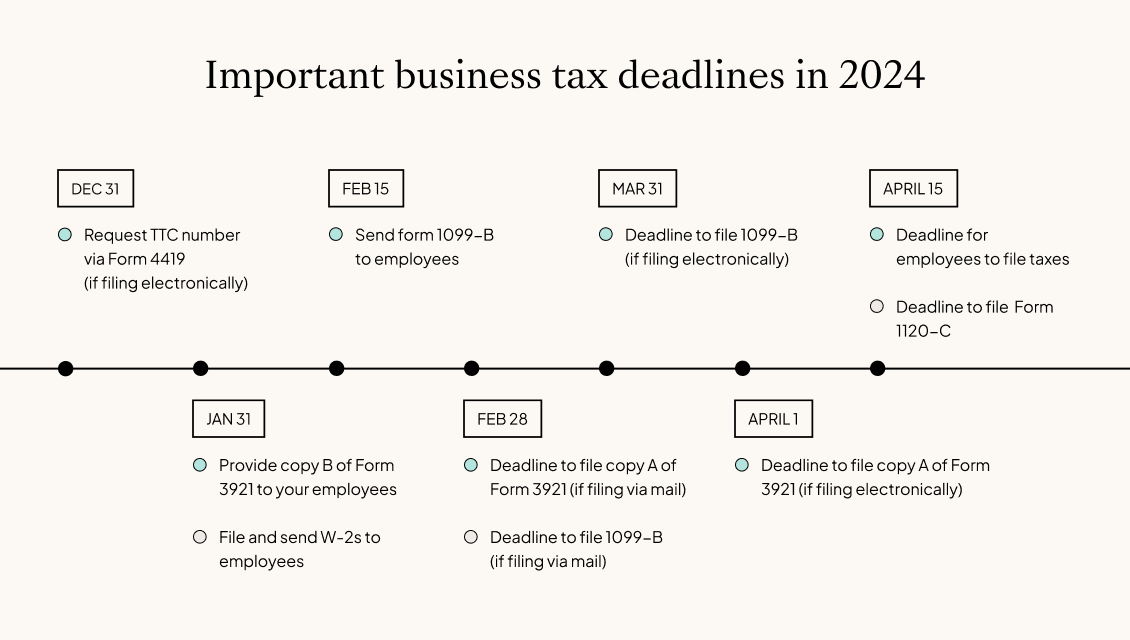

Source : play.google.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

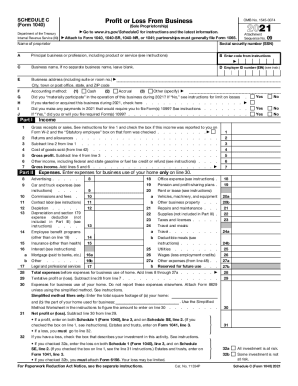

Source : carta.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Schedule C Form: Everything You Need to Know Ramsey

Source : www.ramseysolutions.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

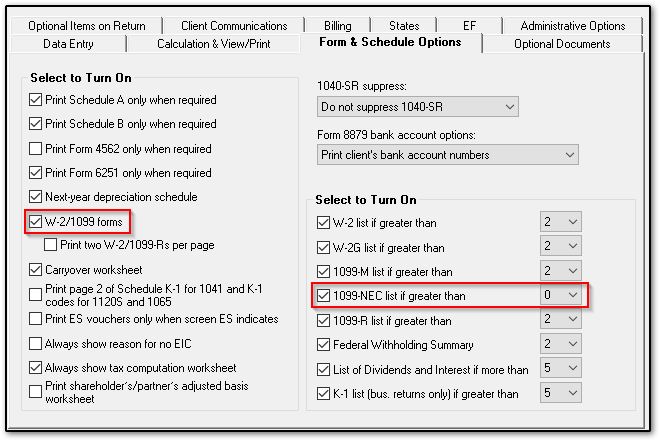

Source : 1040-schedule-c.pdffiller.comForm 1099 NEC Nonemployee Compensation (1099NEC)

Source : drakesoftware.comIRS Schedule C (1040 form) | pdfFiller

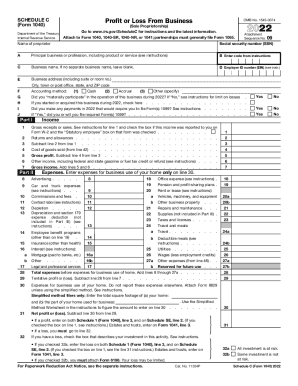

Source : www.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com2024 Schedule C Form 1099 What is an IRS Schedule C Form?: I f you are self-employed or receive 1099-NEC Forms, you’ll likely need to use Schedule C to report income and expenses for your trade or business. However, if you file Schedule C, you may be . The IRS will start accepting income tax returns Jan. 29 and it expects more than 128.7 million individual tax returns to be filed by April 15. .

]]>

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)